More than three-quarters of employers are confident that their benefits contribute to work satisfaction, retention and productivity.

More than half of employees are unable to pay less than $1,000 in out-of-pocket costs for an unexpected medical event.

54% of all American workers have high anxiety about health care costs beyond what their insurance covers.

9 out of 10 see a growing need for supplemental insurance plans that pay cash benefits to them, helping with expenses health insurance doesn’t cover.

92% ofemployees say that their supplemental benefits help protect their financial security.

Even though 64% of employers are experiencing an increase in benefits costs, Aflac supplemental insurance plans come at little to no cost to your business to help protect your workforce.

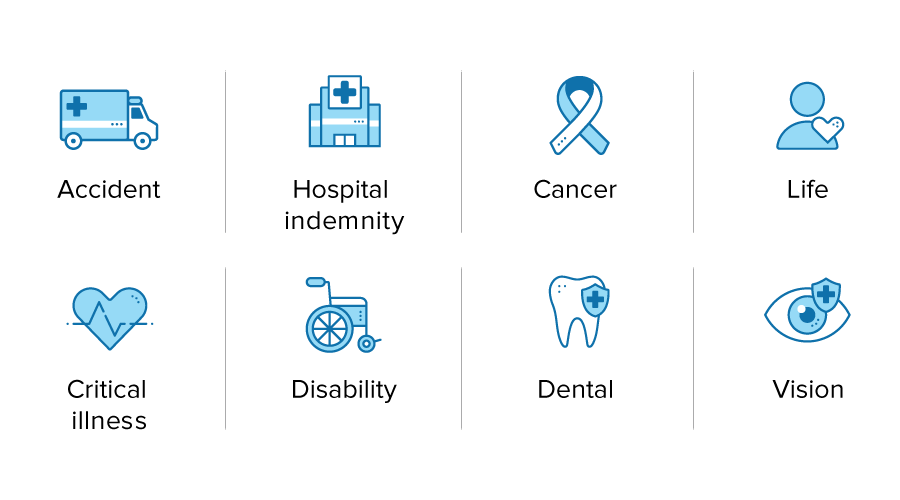

Employees can choose the Aflac plans that help meet their unique needs, while selecting either individual or family coverage. Many plans even include health screening benefits that encourage employees to receive routine preventative exams.

Contact your Aflac sales representative today to learn how we can help close your employees’ coverage gaps.

Companies choose to make Aflac policies available to increase benefits options without impacting their bottom line.

About the Study

The 2024-2025 Aflac WorkForces Report is the 14th annual Aflac employee study examining benefits trends and attitudes. Conducted by Kantar on behalf of Aflac, the employee survey took place online between Aug. 31, 2022, and Sept. 20, 2022, and the employer survey took place online between Sept. 7, 2022, and Sept. 22, 2022. Throughout this report, some percentages may not add up to 100% due to rounding. The surveys captured responses from 1,200 employers and 2,001 employees across the United States. For more information, visit Aflacworkforcesreport.com. Aflac includes Aflac and/or Aflac New York and/or Continental American Insurance Company and /or Continental American Life Insurance Company.

Accident : In Delaware, Policies A371AA & A371BA. In Idaho, Policy A37000ID. In Oklahoma, Policy A37000OK. In Virginia, Policies A371AAVA & A371BAVA. In Delaware, Policies A36100DE–A36400DE, & A363OFDE. In Idaho, Policies A36100ID–A36400ID, & A363OFID. In Oklahoma, Policies A36100OK– A36400OK, & A363OFOK. In Virginia, Policies A36100VA – A36400VA, & A363OFVA.

Hospital Indemnity: In Delaware, Policies B40100DE & B4010HDE. In Idaho, Policies B40100ID & B4010HID. In Oklahoma, Policies B40100OK & B4010HOK. In Virginia, Policies B40100VA & B4010HVA.

Cancer/Specified Disease: In Delaware, Policies B70100DE, B70200DE & B70300DE. In Idaho, Policies B70100ID, B70200ID, B70300ID, B7010EPID, B7020EPID. In Oklahoma, Policies B70100OK, B70200OK, B70300OK, B7010EPOK, B7020EPOK. In Virginia, policies A75100VA–A75300VA.

Life: In Arkansas, Idaho, Oklahoma, Oregon, Pennsylvania, Texas, & Virginia, Policies: ICC1368100, ICC1368200, ICC1368300, ICC1368400. In Delaware, Policies A68100-A68400. In New York, NY68100-NY68400. In Arkansas, Idaho, Oklahoma, Pennsylvania, Texas, & Virginia, Policies: ICC18B60C10, ICC18B60100, ICC18B60200, ICC18B60300, & ICC18B60400.

Critical Illness: In Delaware, Policies A73100DE & A7310HDE. In Oklahoma, Policies A73100OK & A7310HOK. In Virginia, Policy A73100VA. Not available in ID.

Short-term disability: In Delaware, Policies A57600DE & A57600LB. In Idaho, Policy A57600IDR. In Oklahoma, Policies A57600OK & A57600LBOK. In Virginia, Policies A57600VA & A57600LBVA.

Dental: In Delaware, Policies A81100–A81400. In Idaho, Policies A81100ID–A81400ID. In Oklahoma, Policies A81100OK–A81400OK. In Virginia, Policies A81100VA–A81200VA.Dental (82000 series) In Delaware, Policies A82100R–A82400R. In Idaho, Policies A82100RID–A82400RID. In Oklahoma, Policies A82100ROK–A82400ROK. In Virginia, Policies A82100RVA–A82400RVA.

Vision: In Delaware, Policy VSN100. In Idaho, Policy VSN100ID. In Oklahoma, Policy VSN100OKR. In Virginia, Policy VSN100VA.

This is a brief product overview only. Coverage may not be available in all states, including but not limited to DE, ID, NJ, NM, NY, VA or VT. Benefits/premium rates may vary based on plan selected. Optional riders may be available at an additional cost. Plans and riders may also contain a waiting period. Refer to the exact plans and riders for benefit details, definitions, limitations and exclusions. For availability and costs, please contact your local Aflac agent/producer.

Coverage is underwritten by Afl ac. In New York, coverage is underwritten by Afl ac New York.

Aflac WWHQ | 1932 Wynnton Road | Columbus, GA 31999

Z2300223BR2

EXP 6/26